Accepting online payments is a necessity today since, businesses have moved beyond the boundaries of physical stores. If you own a business but do not have a website and you wish to accept Payments online, then the best way is to use the payment links. You can easily and conveniently accept payments through the same. For those who are not ready with digital payment options, then structuring everything immediately can be expensive, time-consuming and a very hectic task. URLs are the most convenient method of accepting payment, apart from that, there are many merchant benefits of Payment Links. Let us begin with understanding, what payment links are, followed by other details that you must know.

What is a Payment Link?

Payment Links are shareable URLs that can be used to collect payments online. The customer would click on the links and gets redirected to a payment gateway checkout to complete the process digitally. Once a customer has made a purchase, a unique payment link can be generated from the merchant dashboard and then shared through WhatsApp, email, or any other means. Apart from being a convenient mode of payment, there are multiple benefits of payment links that are discussed further in this blog.

Easy On Pocket

For small business owners, Payment links can help save expenses. All you need to do is integrate your existing website with the Payment Gateway and generate a payment link, which can be shared further via various modes of online communication. This mode of payment reduces the overhead price of installing payment devices such as POS terminals or any other third-party applications. Few payment apps offer to pay as you go model, under which merchants pay as per transaction cost, based on usage and not on a monthly subscription.

Convenient for Customers

Making purchases using a payment link is easier for customers. All you have to do is to click open the link and complete the transaction in your preferred mode of payment. With all the security and compliance, payment links are one of the swiftest and most secure payment methods. These links can be personalised and then given to the customers for making payments. The usage of links enhances the overall shopping experience by giving customers, the freedom of choosing from multiple modes of digital transaction.

Reduces Processing Time

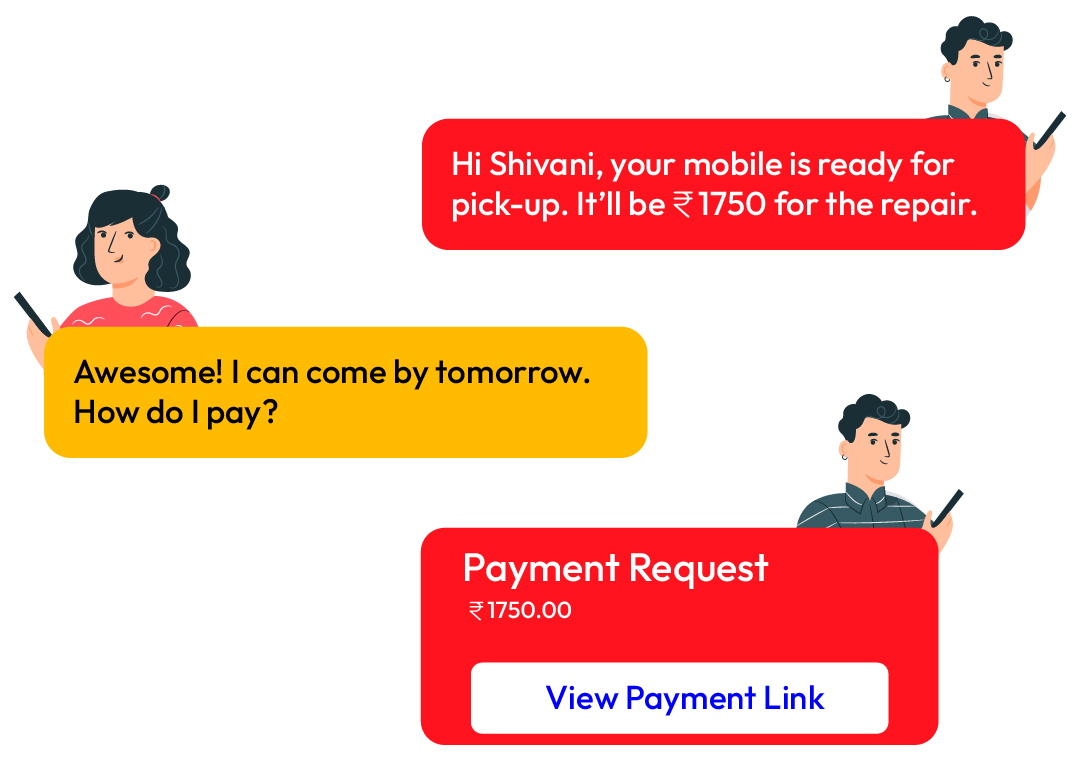

The best feature of payment links is that the merchant doesn’t have to meet with the party who is paying. They can simply generate a link embedding the required information about the purchased products and the amounts. Using these links customers can instantly pay irrespective of the place theyare at. The amount can be automatically transferred to the merchant’s account without having to pay for any additional application or third part

Security

Doubt is a very common thing that arises while a customer is making an online payment. As a merchant, if you are using payment links from a secured source, it adds to the trust that your customers have in you. While making a payment, a sense of security is critical, and it can affect your sales directly. Pay10 is one of the most reliable and leading payment gateways in India that is PCI DSS level 1 compliant, SSL certified and follows encryption standards. If you are planning to deploy a payment gateway then make sure to check the digital payment security features that are offered.

Technical Requirements

If you are a small business owner and have just ventured into a start-up, there are chances that you are not sound with the technicalities regarding payments and banking technology. Payment links can be your saviour in this case, they can save you from enigmatic tech integrations. A good payment aggregator can satiate your needs without you having to take any burden. Once your merchant account is configured, the business owner can generate a payment link with a simple click and send it to the customers through the dashboard of the merchant’s account.

Benefits of Payment Links Based on The Type of Business You Own

For Small Businesses or Start-Ups

If you have just started your venture or if you do not process a lot of online sales, then it might be a little cost-inducing to invest in a complete payment solution. Payment links are affordable and easy to use, with the advantage of multiple payment modes. Just share your payment Links with the customers you want to collect funds from and get paid instantly.

If Payment Volumes Have Large Peaks and Troughs

If you are into a venture that does yearly fundraiser drives to track the transactions and payments they processed during the tenure, adding a payment gateway to the website can be hard on the pocket. Payment links are an excellent option that prevents the redirection of customers to an external website and allows the tailoring of end-to-end sales journeys to specific platforms.

Freelancers

If you are a freelancer, then accepting money through payment links can be easier and hassle-free Without having to share your bank details and leaving a scope of typing errors, you can simply generate a payment link and share it with your client. Integrate your existing website with the Payment Gateway of your choice and it will be sorted. Being a freelancer, you will find payment links more intuitive, as these can be tailored based on the submitted deliveries and projects

How Does the Payment Link Function?

Let’s take a quick rundown on how Payment Links work. Customers receive the payment link with “Pay Now”. Once they click on the given link, they are taken to a page that displays their invoice details and the amount to be paid. By aggreging to pay the customer can successfully complete the transaction. Here are the detailed pointers, that might know.

Customise Your Payment Page

There are many Payments Processing companies in India that you can subscribe to, and avail of the payment link feature. The payment provider will offer a secure payment page where customers will land and enter/check their payment information after following the link.

Sharing the Payment Link

Once you have created the payment page, you are all set to initiate a transaction. Usually, the payment providers automate the payment workflow for sending payment links via email or SMS. You can also paste the link on your website or share it directly. There is more than one way of sending payment links to customers, depending on the business type.

Making the Payment

Once you have shared the payment link with your customers, they can simply click the link and access the payment page that you created. They will require to add the payment details based on their preferred mode of payment and complete the transaction instantly.

When everything is so advanced and easily accessible, then making and accepting payment should be equally convenient. No matter what your niche is, Payment link offers a low-maintenance payment solution that makes real-time payments easy for both the merchant and the customer. Pay10 is a secure digital payment service provider that allows your business to quickly generate Payment Links and receive instant payments with no hindrance or deviation. Contact us for top-notch FinTech Services for your business.